Welcome to FanNation, Part of the Sports Illustrated Media Group

Find and follow your favorite team here. Get the latest news and updates about the team you care most about.

Could J.J. McCarthy Be Drafted at Third Overall?

With less than 48 hours until the NFL Draft is set to begin, there is buzz about Michigan quarterback J.J. McCarthy potential going higher than initially expected.

Recent Articles

Adjustments to Expect from the Heat in Game 2 vs. Celtics

A look at some of the adjustments the Heat might make to give themselves a better chance of keeping pace with the Celtics than in their 114-94 loss in Game 1.

Jaylen Brown Details Kristaps Porzingis' Importance Against Heat

At Boston Celtics practice on Tuesday, Jaylen Brown detailed the importance of Kristaps Porzingis' defense in their series against the Miami Heat.

More Concern About Caleb Williams Focuses Attention on Coaches

Bears coaching staff's ability to support Caleb Williams comes under fire from college football insider.

Gallery: Nebraska Baseball Falls to Kansas, 9-4

Huskers can't overcome Jayhawks' early lead

Ex-FSU Football Offensive Lineman Commits To ACC Program, Will Face 'Noles In 2024

The former Seminole will face his old program in September.

Key Bench Piece For Dallas Mavericks Suffers Injury In Game 2 Against Clippers

Mavericks suffer second key injury of the night

Virginia Baseball Powers Past Liberty 14-4 in Seven Innings

The Cavaliers bounced back from their disappointing weekend with a 14-4 run-rule victory over the Flames in seven innings on Tuesday night at Disharoon Park.

NIL Compensation Has No Effect on Titans' Ability to Evaluate Athletes, but It Does Reduce the Draft's Talent Pool

"I don't think NIL has affected how we scout players at all. Honestly, that's a college deal because we've always paid players," said Tennessee Titans general manager Ran Carthon. But there are 58 underclassmen in the 2024 draft — the fewest since 2011 and down from 130 in 2021, before NIL laws took effect.

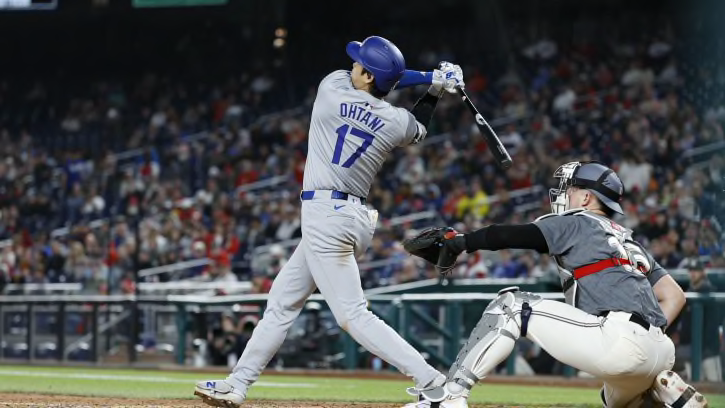

Los Angeles Dodgers Superstar Shohei Ohtani Blasts Hardest-Hit Home Run of 2024

Shohei Ohtani set a Statcast era record for the Los Angeles Dodgers with his 119 mile-per-hour, 450-foot home run against the Washington Nationals on Tuesday.

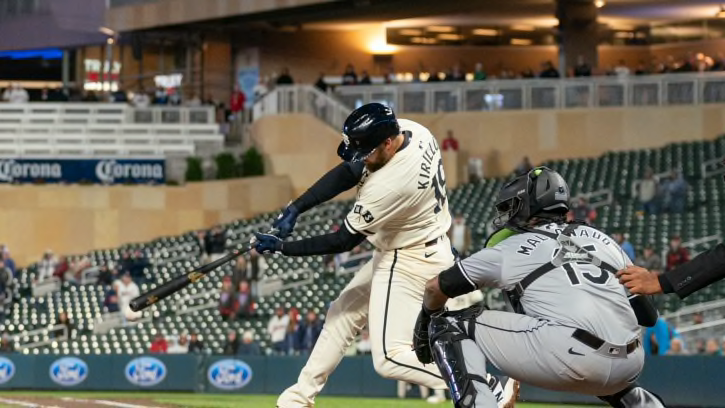

Buxton hits game-tying homer, Kirilloff walks it off in Twins' 6-5 win over White Sox

The Twins beat the White Sox for the second day in a row.

Jaylen Brown praises Jrue Holiday’s leadership after momentary lapse vs. Heat: ‘He was right’

After a defensive breakdown against the Heat, Holiday urged his teammates to refocus. At Tuesday’s Celtics practice, Joe Mazzulla and Jaylen Brown reiterated the importance of Holiday’s leadership in those moments.

Guardians Pitcher Hunter Gaddis Is Thriving In His New Role

The 26-year-old Cleveland reliever currently owns MLB’s longest scoreless appearances streak so far this season.

Philadelphia Eagles Expected to do One of Two Things in First Round

General manager Howie Roseman has been known to use the same process each year. Will 2024 be the year he deviates?

“Outstanding:” Ben Lively Shines As Guardians Overcome Rainy Conditions

Ben Lively pitched 6.1 innings in the Cleveland Guardians' 4-1 victory over the Boston Red Sox.

D-backs Power to 14-1 Victory Behind Henry's Strong Outing

Tommy Henry fired six strong innings and Pavin Smith led the offense with a Grand Slam and six RBI.

Virginia Softball Falls at Virginia Tech 6-1 in Commonwealth Clash Rematch

After a historic series win against No. 3 Duke, the UVA softball couldn’t keep up the magic against in-state rival Virginia Tech, falling 6-1 in Blacksburg.

Eleven-Run Third Inning Propels Alabama Baseball to Midweek Win Over Samford

The Alabama baseball offense came alive in a big way on Tuesday night.

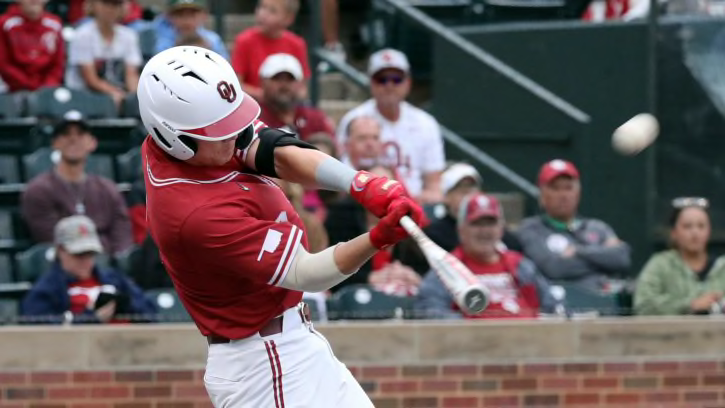

OU Baseball: Oklahoma Pitching Holds Off Wichita State

The Sooners managed just three hits, but two scored runs as OU took an early lead over the Shockers and then held them off with five shutout innings down the stretch.

Indiana Pacers use dominant Pascal Siakam outing to win Game 2 over Milwaukee Bucks, even up series at 1-1

The Pacers and Bucks played Game 2 on Tuesday night

At the Corner of Dixon and Jackson is a Fierce Position Battle

The two defensive backs plus Leroy Bryant are all chasing the same secondary spot.

Here Is List of Packers’ 2024 NFL Draft Picks, Biggest Needs

The Green Bay Packers will enter the 2024 NFL Draft with 11 draft picks. GM Brian Gutekunst would rather have more than less.

Dallas Mavericks Starter Suffers Injury, Exits Game 2 Against Clippers

Key member of the Mavericks' frontcourt is questionable to return

Dallas Mavericks Starter Suffers Injury, Exits Game 2 Against Clippers

Key member of the Mavericks' frontcourt is questionable to return

Ex-NFL GM Believes Giants Should Not Draft a Quarterback in Round 1

Rick Spielman outlined why the Giants should stick with Daniel Jones at quarterback.