Welcome to FanNation, Part of the Sports Illustrated Media Group

Find and follow your favorite team here. Get the latest news and updates about the team you care most about.

Raiders Address OT in FanNation 2024 NFL Mock Draft

Raiders Today's Hondo S. Carpenter Sr. picked offensive tackle Taliese Fuaga with the Las Vegas Raiders' 13th overall pick in FanNation's 2024 NFL mock draft.

Recent Articles

BYU Quarterback Recruiting Update, BYU QB Battle Prediction and More in the Monthly Mailbag

Taking questions in the first monthly mailbag

LSU Football: LSU Transfer Jaxon Howard Reveals Transfer Destination

Howard became the first Tiger to depart the program this spring, quickly finds new home via the portal.

Mets Superstar Surprisingly Mentioned As Option For Yankees By Insider

Could the Yankees pursue the rival Mets superstar this upcoming offseason?

Pitt's Jeff Capel Reacts to Damian Dunn Addition

The Pitt Panthers made the addition of Damian Dunn official.

Historic 3-Point Shooting Season Has OKC Thunder Poised for Playoff Run

The Thunder led the league in 3-point shooting, which could make them a significant threat in the playoffs.

Celtics Head Coach Joe Mazzulla gives glimpse into his competitive mindset

In his second-year at the helm, Celtics head coach Joe Mazzulla has helped guide Boston to the NBA's best record, securing home-court advantage for the duration of their playoff run.

Insider Reveals Patriots' Interest in Drake Maye & Jayden Daniels

How do the New England Patriots truly feel about the top signal callers in the draft?

Ole Miss Rebels, Lane Kiffin Release Parody Taylor Swift Album Cover

Lane Kiffin is a certified Taylor Swift fan, and the Ole Miss Rebels took advantage of that this week.

FanNation Mock Draft: Finding the Chiefs' Answer at WR Without Trading Up

The Chiefs were able to land an explosive playmaker at wide receiver at the end of the first round in FanNation's 2024 NFL mock draft.

Sam Hauser details Brad Stevens’ impact on him joining Celtics over Heat

Sam Hauser spurned the Heat to join the Celtics, where he's become a rotation fixture and key contributor to Boston's success.

Insider Reveals Cardinals Priority in NFL Draft

The Arizona Cardinals could look to identify these two positions in the 2024 NFL Draft.

Eagles' Exec Believes In Keeping The Draft Simple

Need is the worst talent evaluator in sports has become a cliche in the NFL's personnel world. The trick is being disciplined enough to realize that.

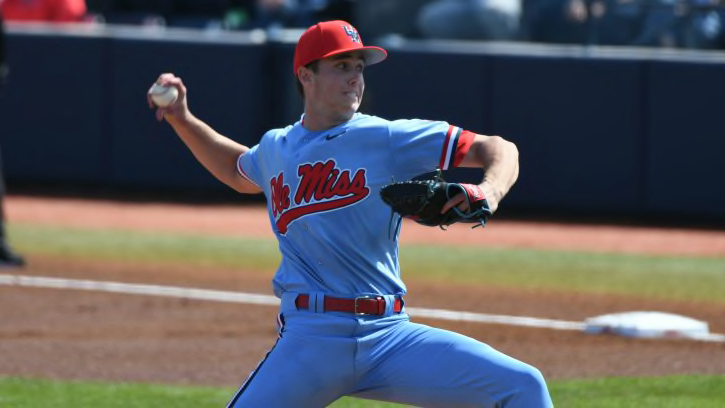

Preview, How To Watch: Ole Miss Rebels Baseball Faces Georgia Bulldogs in Athens

The Ole Miss Rebels return to play this weekend when they travel to face the Georgia Bulldogs in Athens.

Cardinals Elite Prospect Surprisingly Mentioned As Trade Candidate

Could the Cardinals actually end up trading one of their top prospects this season?

Action Will Speak Louder Than Words for Giants on Quarterback Decision

The Giants have tried to downplay the need for a quarterback, but there are too many signs to ignore that suggest otherwise.

Miami Heat Star Chirps at Sixers’ Kelly Oubre After Play-In

Miami Heat forward had a message for Philadelphia 76ers veteran, Kelly Oubre.

Huskies Will Try to Do Moore at TE with Less

The lone veteran returning at the position is looking to build on his receiving output.

LSU Football: Trio of Young Tigers Enter NCAA Transfer Portal on Friday

LSU is up to to six players departing the program during the spring portal window as roster reconstruction continues.

Suns vs Timberwolves Playoff Preview

Taking a look at both sides, breaking down advantages for both sides, and predicting the series.

Kings-Pelicans Injury Report: Zion Williamson Update

The Sacramento Kings will head to New Orleans for a spot in the playoffs.

Brett Veach on Dealing With AFC Teams, Chiefs' NFL Draft Trade Process

Less than a week before the draft, Veach spoke about his process with trades and the challenge of working with other conference rivals.

Tanner Terch Recaps Nebraska Visit and Offer: ‘I’m Still in Shock’

2025 WR/TE from Colorado calls it ‘truly indescribable’ to have the staff believe in him

Dodgers Viewed As Top Landing Spot For Red Sox Slugger If He's Traded

Los Angeles could be an interesting match for Boston in a possible trade

Tampa Bay Rays' Slugger is the Active Leader in this Wild MLB Category

Tampa Bay Rays' slugger Isaac Paredes is the active Major League leader in this wild statistical category. We had to check twice just to make sure it was true.